Toronto, Jan. 07, 2019

By Andrew Ipekian

As we begin our new year of 2019, here at Ipekian we dive into TREB’s yearly data to see what buyers and sellers might glean and give you our take on trends in GTA real estate.

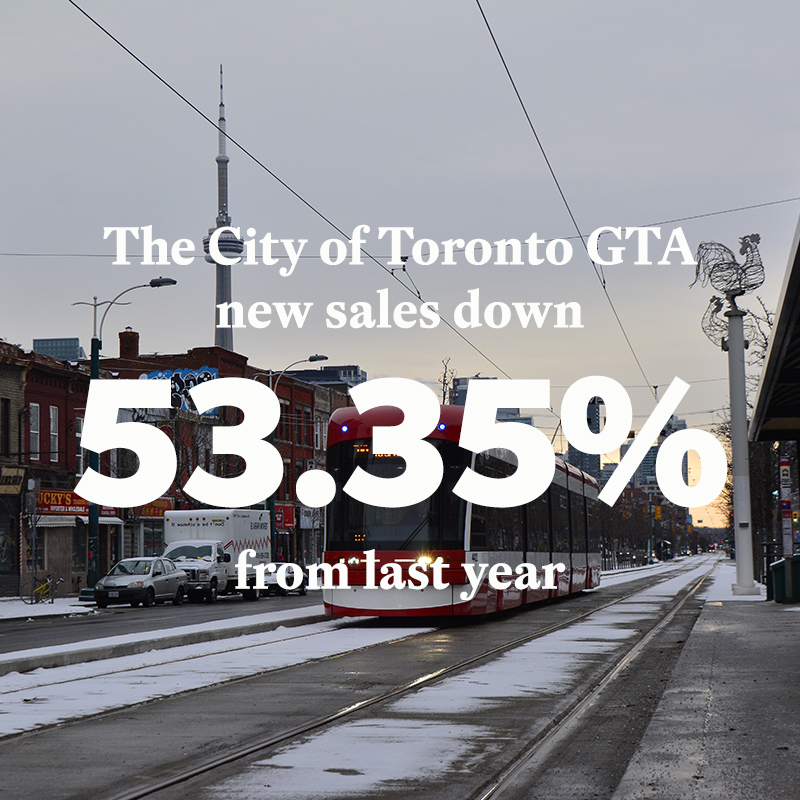

the deliberate efforts by the government to cool the crazy 2017 market by decreasing demand worked – sort of. Volume was down 16.1% and prices down 4.3% overall in the GTA, compared to 2017 numbers, but it was the high end where the policy really laid a beating – singles volume was down a whopping 24.1% and singles prices down 8.0%.

But the GTA remains a very appealing place to live, work and own real estate, in global terms and overall demand remained high – all that money just went shopping for properties in a lower price band. That’s why we saw the condo market remain very strong, with 22,850 apt sales resulting in a 10.4% increase in prices over last year.

Back to the location x 3 bit – there were pockets in the 416 where singles were snapped up quickly, over asking with multiple bids. And these pockets in W01, W02, E01 and E02 will shock no one, as they tend to be safe, quiet neighbourhoods with stability, good schools, transportation and lots of amenities. Names like High Park, Roncesvalles and Swansea in the west and Beaches, Leaside and Riverdale in the east jump out.

Second, and not helping the issue, they (newsflash) didn’t make any more land in 2018 in the GTA. That means the only way anything gets built is through density – and so towers go way up – either in price or in height. We need only look at the corner of Yonge and Bloor to see that. I think that mixed-use towers (retail/commercial/condo-on-top) of 60, 70 or 80 floors are going to become more and more common as the price of land, through scarcity, continues to rise.

Someone in the office the other day mentioned that downtown parking lots are going to be an endangered species as they all become condo highrises.

Third, we’re also seeing, as more boomers retire and downsize, more demand for larger condos in smaller, upscale buildings – the opposite of the younger end of the spectrum. So the condo market will continue to bifurcate into smaller, cheaper units in very tall mixed-use buildings and pricey, larger units in smaller, upscale buildings in more available infill locations.

The provincial government announced at the end of the year a measure to remove rent control from newly built properties. This should spur new supply, but it will not be friendly to rents, as investors will seek this good ROI (Higher costs? No prob, jack the rent!) over a clearly volatile stock market that we’re currently seeing. And as price/sq ft here is still low on a global scale, we should see a fair bit of offshore investment money come in to buy up this new supply.

So, in a word, 2018 was … muted. But I think the shock is working itself out as the supply side adjusts to the new buy-side realities.

Also in a word, 2019 I suspect will be flat. Certainly, we’ll see more rental pressure. Prices in good neighbourhoods will continue to slowly rise. Condos will continue to be hot and weèll see more catering to international buyers.

There are a few wildcards. The Portlands for instance what kind of planned community does the city have in mind for the largest lakeside parcel available? Same question for Downsview, although 2019 might be a bit early for that.

We will also see less dramatic headlines in 2019, as we stop comparing our data to a crazy 2017 and move to a more normal 2018. Lies, damn lies and statistics, as they say! As we always close, if I were having a coffee with a client in the next week, I’d be saying one thing for sure: there will be a lot of timidity and hesitation in 2019. And when others hesitate, it creates opportunities for those who are well informed, sure about their goals and confident in their plans to get there. Make sure you’re one of those latter people.

Have a healthy, happy 2019 and I hope we get to chat soon over a coffee!

To see the original TREB data for November 2018 click here