Toronto, Dec. 06, 2018

By Andrew Ipekian

As 2018 closes out, here at Ipekian we dive into TREB’s monthly data to see what buyers and sellers might glean and give you our take on trends in GTA real estate.

This month we have a classic case of ‘the devil is in the details.’ Headlines instantly screamed “Toronto area home sales fall sharply in November: TREB.” But what they don’t tell you until you’re well into the article is that they’re measuring YoY numbers against an abnormal November 2017, when there was a burst of activity just before the new stress test measures/mortgage rules went into effect. In fact, November sales fell just 3.4% compared to October on a month-over-month basis after adjusting for seasonal variations. In other words, pretty normal. But even that’s over the entire GTA area that TREB covers, and for those interested in Toronto proper and not, perhaps, Innisfil or Milton, the data does reveal some interesting points. Overall, though, there are few key takeaways to be had comparing to November, 2017.

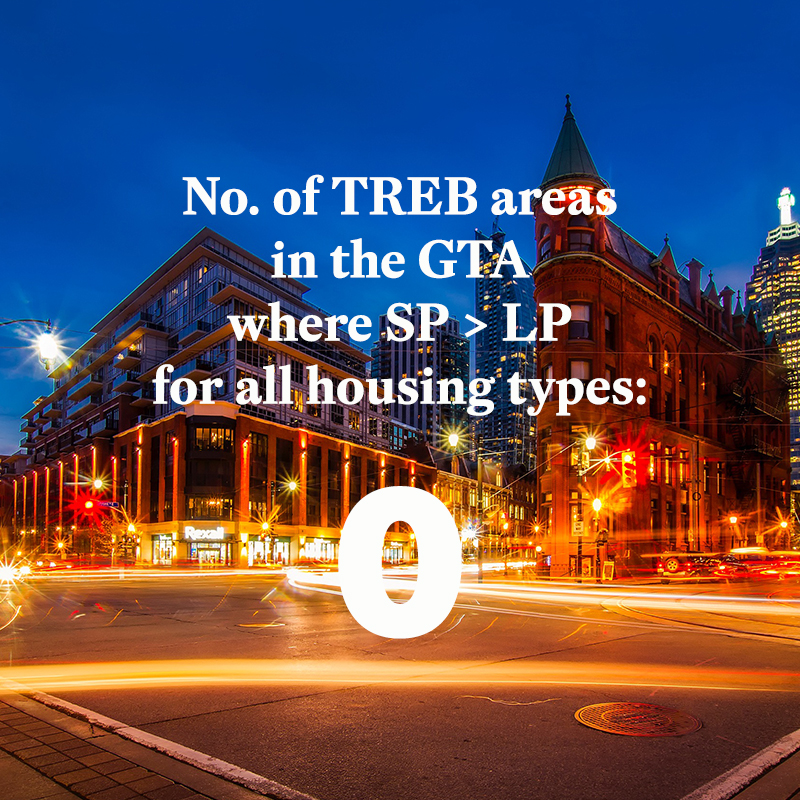

Numbers do show that GTA prices continue to climb nicely for semis and condos in both the 905 and 416, and even singles prices are up a little bit in both. But nowhere in the 905 were singles on average selling for over asking, perhaps indicating that sellers are still a bit optimistic compared to what buyers are giving. Even in the 416, singles are on average going for over asking only in certain more desirable neighbourhoods, where the continued lack of supply depressed selection for the current demand.

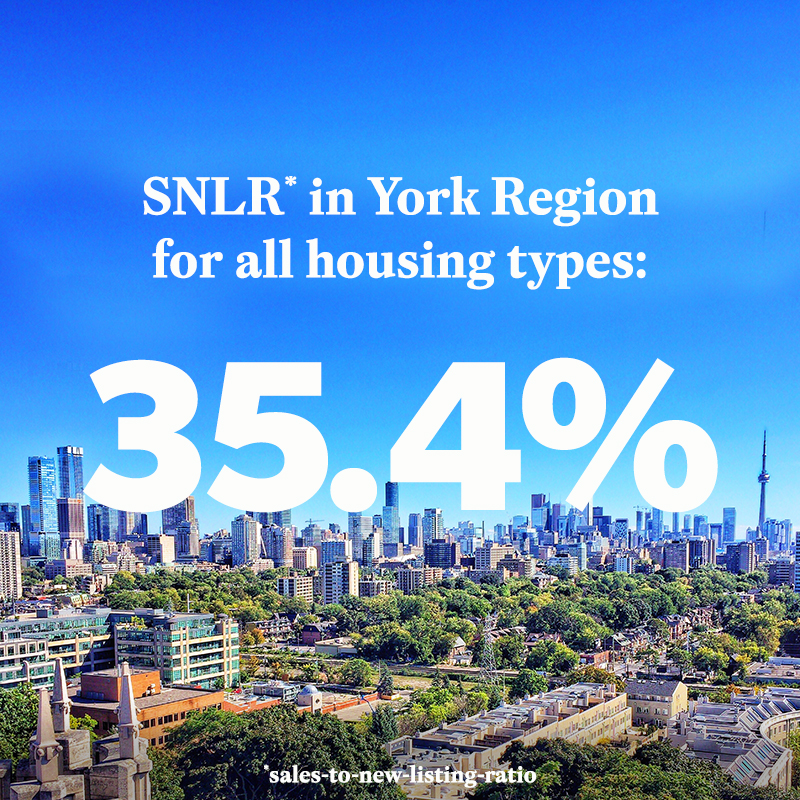

New listings are again down overall from last year, but good news for buyers – they still outpaced sales in November across all housing types, meaning we are seeing perhaps a sign of expanding inventory. In fact, the SNLR (sales-to-new-listing-ratio) in York Region is only at 35.4%, meaning new supply was 3 times(!) what sold. In fact, the SALR (sales-to-active-listings ratio) in York Region is the only one more or less in balance (i.e. between 12% and 20%) in all of TREB at 16.5%. (By comparison, the SALR of condos in the 416 is at 63.2%, which is a strong sellers’ market, explaining the price increases.) Overall, this could mean two things in York: one, that many new listings are giving buyers a bit more clout and may drag on prices a bit, and that some of the pent up supply that has been waiting for a price uptick (which has happened) is now going to hit the market.

Also, recent events (Oshawa-GM, oil price, China trade, Indices plunges, M2++ growth decline) have now put something of a damper on expectations for a rate hike any time soon, which should remove some downward pressure on demand.

In terms of new condos, the building is still happening, especially in Peel, but developers are trying to appeal to smaller budgets with even smaller units, on average. This will likely continue to dampen appreciation somewhat over the long term.

So, November exhibited the typical annual cooling we get overall approaching the holidays and we saw that it brought a little more supply.

Over coffee with my clients this week, I’ll (again in most cases) be telling them:

-

-

It’s still a seller’s market for condos, and still a great time to use built-up equity to trade up to whatever your next step is. Especially into a detached. Especially if you’re willing to look into York Region.

-

-

-

It’s a buyer’s market in single family homes, and some great deals can be finessed from people who, if they’re in this market, in December, might need to sell. That gives some added buyer leverage.

-

-

With the continuing GTA population growth and significant rental scarcity, new condos remain, in global terms, a great place to park your money for significant returns via rent and appreciation, especially if you can afford a larger unit.

To see the original TREB data for November 2018 click here